EMI Calculator For Home Loan, Car Loan and Personal Loan in India

0 10,000,000

12 360

3 30

0 5,000,000

12 360

3 30

0 5,000,000

12 360

0 30

0

Monthly Payment (EMI)

0

Total Interest Payable

0

Total Payment

(Principal + Interest)

(Principal + Interest)

EMIs

What is EMI?

EMI is equated monthly installment. EMI is monthly basis repayment of the loan amount taken. A loan amount, be it home loan, car loan or personal loan is paid back through a series of monthly payments. The monthly payment is in the form of post dated cheques drawn in favour of lender. EMI are paid until the total amount due is paid up. EMI is directly proportional to the loan amount taken and inversely proportional to time period. That is if loan amount increases the EMI amount increases too and if time period increases the EMI amount decreases. It does not mean you have to pay less but rather the monthly amount is decreases since total number of months of repayment have been increased.

How is EMI calculated?

EMI is made up of two variable components- principal amount and interest rate. The EMI is fixed but not the components. The component of interest amount is higher in initial years and decreases over the years. The component of principal amount is lower in initial years and increases over the years.

For this reason, if you consider pre-payment, you should do it in early years as you save on interest rate.

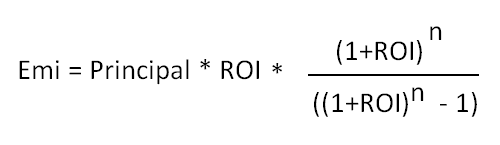

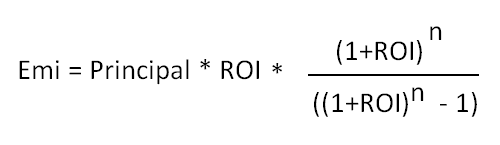

EMI (Equated Monthly Installment) calculation formula :

EMI : Equated Monthly Installment

Principal : Loan Amount

ROI : Rate of Interest [Monthly basis - Ex. 13.5 p.a = 13.5/100/12 = 0.01125 ROI]

n : no of months

Monthly Interest Adjust : Begining Balance x ROI [Ex. 2,500,000 x 0.01125 = 28,125]

Monthly Principal Adjust : EMI - Monthly_interest [Ex. 38,069 - 28,125 = 9944]

For this reason, if you consider pre-payment, you should do it in early years as you save on interest rate.

EMI : Equated Monthly Installment

Principal : Loan Amount

ROI : Rate of Interest [Monthly basis - Ex. 13.5 p.a = 13.5/100/12 = 0.01125 ROI]

n : no of months

Monthly Interest Adjust : Begining Balance x ROI [Ex. 2,500,000 x 0.01125 = 28,125]

Monthly Principal Adjust : EMI - Monthly_interest [Ex. 38,069 - 28,125 = 9944]